How to Choose a Mining Pool?

- DR.GEEK

- Sep 13, 2019

- 2 min read

( 13th September 2019 )

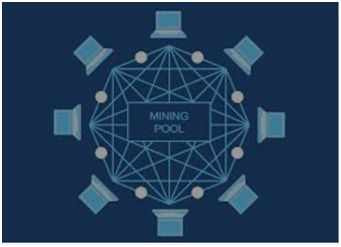

At its core, mining is the process by which computational power (hash power) is used in an attempt to unlock a block in a blockchain. Each block unlocked provides a reward. The more attempts (hashes) you can perform per second, the higher the probability that you will obtain the reward. Because miners by themselves typically don’t have enough hashing power to frequently find blocks, they join a pool that combines the hash power of multiple miners to hash blocks.

With greater collective hashing power, it is easier to find blocks with decreased variance. The reward is split among the miners relative to the proportion of hash power that they contributed to the pool. The pool operator collects a small service fee. Choosing the right mining pool is crucial for the efficiency of a mining operation.

What to Look for When Choosing a Mining Pool?

Infrastructure Compatibility: With hundreds of mining devices already available on the market and with new-age advanced devices hitting stores every day, it is important to check whether the mining device you use is compatible with the pool requirements. For example, Slushpool, one of the oldest mining pools, clearly advises against the use of CPU, GPU, or smartphone-based mining. Similarly, a pool may not support the use of any and all mining software packages, and one may need to use only the software that is compatible with the pool. Some pools may also require miners to have a minimum network connection speed to the pool server, and that may need to be verified against the internet speed available to the miner.

Payout Structure of Preference: A pool can payout rewards to its miners based on a Pay-Per-Share (PPS), Pay-Per-Last-N-Shares (PPLNS) and Proportional (PROP) basis, three methods with their own costs and benefits.

Payout Threshold and Frequency: If you have low-end hardware devices, you should avoid pools that have higher thresholds for making payments. Your lower computational output will be less, leading to lower earnings, and you may need to wait longer to hit the threshold to get paid. The same applies to the payment frequency of the mining pool.

Team Trustworthiness and Pool Reliability: Given the lack of governance and infancy in the crypto space, it is vulnerable to unethical practices by service providers. This danger increases the importance of choosing service providers that have credible development teams.

Extra features: Quality pools generally offer enhanced UI and UX design, equipping users with functionality that allows them to monitor their performance and mining statistics.

Fee: Generally, service fees range from 1–3% and exist to pay for the pool’s operating expenses and the interface functionality provided to users. Along with pools that charge a nominal fee to participants for using the mining pool services, there are pools that charge no fee at all. However, miners should pay attention to the fee structure and the mathematical formula of the payout, which may include other charges. Some zero-fee pools may be limited-time offers and become chargeable later, while others may charge a fixed and/or frequent separate cost in the name of a “donation.” Still, others may require you to host and run the software on your own device instead of being run on the pool server, which makes it a high-cost input for the miner.

Comments